Many individuals with AFib have Paroxysmal Atrial Fibrillation. When we hear from individuals with this type of AFib we typically get two questions regarding life insurance. The first question often is can I qualify for life insurance with Paroxysmal Atrial Fibrillation. Generally the next question is how much does it cost? The answer to those questions are yes you can qualify, and it depends on a lot of factors. This guide will lay out how insurance companies rate polices of individuals with Paroxysmal AFib. We will also give some examples of premiums, and identify how we can help you secure the best rate. First, let’s briefly examine what Paroxysmal Atrial Fibrillation is.

Life Insurance with Paroxysmal Atrial Fibrillation

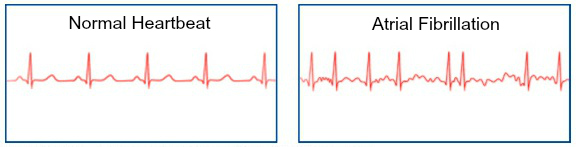

Sometimes Paroxysmal Atrial Fibrillation is referred to as Intermittent Atrial Fibrillation. The upper chambers of the heart known as the atria, lose their normal rhythm and beat frantically. The majority of episodes from Paroxysmal AFib are asymptomatic.

Symptoms include:

- Palpitations

- Chest Pain

- Weakness and fatigue

- Dizziness

- Confusion

- Shortness of breath

- Lightheadedness

Some of these episodes can last for minutes while others may last for several days.

One of the risk factors from AFib is blood clots. With the irregularly rhythm, blood doesn’t flow properly through the heart. The danger of stroke is increased due to these factors. As time goes by, there is also the chance of Paroxysmal AFib progressing to Permanent Afib.

How Do Insurance Companies Underwrite Paroxysmal Atrial Fibrillation?

Life insurance companies will focus on several factors when underwriting you, in particular how well your Paroxysmal Atrial Fibrillation is managed. Underwriters will exam how old you were when diagnosed. If you were before 60 generally this is better than if after 60 when diagnosed. They will look at recent EKGs, your symptoms, frequency of episodes, and any medications and/or treatments. In addition underwriters will want to know if you smoke or if you have any other health issues at all. Most of the information will be obtained from your application and medical records from your doctor and cardiologist.

How Much Does Life Insurance Cost for Those with Paroxysmal Atrial Fibrillation?

The cost of life insurance with Paroxysmal Atrial Fibrillation can vary quite a bit. This is why it is critical to work with an agent that has the experience of working with AFib cases, and represents multiple companies. If aside from Paroxysmal AFib you are in excellent health, a non-smoker, and only had a few episodes over the last several years, you could qualify for possibly a preferred rate. This is rare, but possible with several companies. Generally, we see individuals qualify at the standard rate. To look at standard or preferred rates, you can run an instant life insurance quote with no obligation. If you have other risk factors such as heart disease, or are a smoker, your only options often times is guarantee issue life insurance. Below are several example rates.

How We Help Individuals with Paroxysmal Atrial Fibrillation Obtain Affordable Life Insurance

Often times we work with individuals who have been declined due to AFib, or are paying more than they should. We have the experience and knowledge to help you since we specialize in assisting people with AFib and other heart conditions obtain life insurance. We know which companies are more inclined to provide better rates, and which companies to avoid. Leveraging our experience can be a huge advantage for you when you are comparing companies and/or are ready to apply.

The Wrap-Up

With Paroxysmal AFib you can purchase life insurance at a reasonable price with reputable companies. Having a basic understanding of what underwriters look at, how they typically rate cases, and utilizing a company like us to help you navigate the pitfalls, will put you on the right track. If you have questions, shoot us a message, or give us a call at 888-930-6599. Our experienced team is standing by to help you.

Speak with an experienced advisor!

Speak with an experienced advisor!